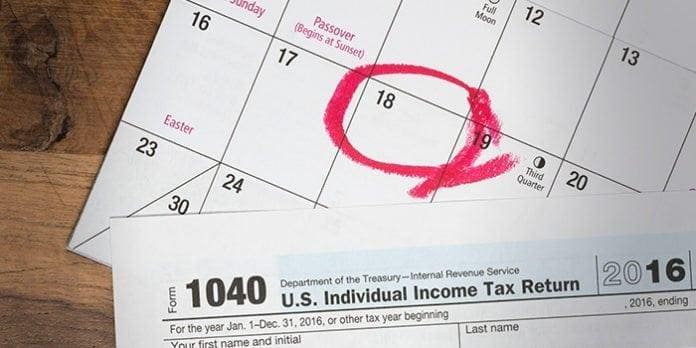

Pull your head out from under the pillow, procrastinators, and listen up: you have an extra three days this year — until April 18 —to file your tax returns. You’re still not ready? You’re afraid you owe the IRS money, and you can’t pay? If you are one of those people who dread April, tax anxieties grow worse when the filing deadline nears. Don’t let your worries paralyze you. The one thing you should not do is put your head back under the bed covers and hope it all goes away. It won’t.

Here’s the easiest action: file for an extension. Do it yourself or get your accountant to do it for you. If you do not already have a long-suffering CPA who knows about your tendency to put this off, seek out a reputable storefront, big box, national chain tax preparer. You know the ones. Don’t trust your tax anxieties to your Cousin Eddy.

Half of your worry probably comes from fear that you’ll mess up a rushed, incomplete return and call down an IRS audit. Getting an extension will give you an extra six months to get duplicate W-2s and 1099s to replace the ones you stuck in a shoebox in the back of your closet and threw out in a cleaning frenzy. Most state governments require you to file an extension with them as well as a federal extension. Rules vary from state to state.

Filing for an federal extension on time will get you out of a late-filing penalty. It won’t get you out of paying taxes owed. Be prepared to estimate what you think you owe when you ask for the extension. You’ll need to pay that amount by the April 18 deadline to avoid late-paying interest and penalties.

The other half of your tax stress may stem from the gnawing certainty in the pit of your stomach that you cannot afford to pay the money owed. If you cannot pay, ask for a payment arrangement. Get in touch with the IRS as soon as you have an estimate on the amount due. Paying installments over time will cost you fees and interest, but knowing that the option exists can relieve a lot of worry.

Paying off the IRS installments before the end of the agreement period will save you money in reduced fees and interest. Once you determine that you can finish paying early, contact the IRS and the agency will adjust your payment amounts.

You may want to consider using your credit card or taking out a personal loan to pay taxes owed. Your accountant can help you determine whether using that kind of credit will cost you less than an IRS installment agreement.

Would it help reduce your stress to learn that you are not alone? Almost 10 million taxpayers are expected to file for an extension this year. For more information on how to file for an extension, the information you’ll need to make the extension request and ways to pay, go here.